Yuan outpacing euro Reuters

RT.com

21 Nov 2023, 15:44 GMT+10

Low interest rates have sparked a global rush to borrow in China, the outlet has said

Global companies are reaping record profits through yuan-denominated bonds and are borrowing heavily from Chinese lenders at low interest rates, at a time when the cost of using Western banks is skyrocketing, Reuters reported on Friday.

According to the news agency, international companies and banks are raising record amounts of cash through Chinese 'panda' and 'dim sum' bonds denominated in yuan.

"While the fundamental story is not compelling for Chinese investors looking for growth, the depreciation of the yuan as well as the rate cuts result in a much cheaper cost of borrowing," said Fiona Lim, senior FX strategist at Maybank.

The uptick in China's borrowing market has made the yuan the world's second-biggest trade funding currency, ahead of the euro. The development reflects Beijing's ambitions to boost the yuan's share in global funding, Reuters added.

According to the report, the National Bank of Canada raised 1 billion yuan ($138.6 million) in October from the sale of a three-year panda bond at a coupon of 3.2%, while domestic interest rates stood at 4.5%.

The People's Bank of China (PBOC) has been encouraging banks to lend to international companies and has allowed broader use of the yuan outside the country, the outlet said.

"Panda bonds are steadily promoting the renminbi's function as a funding currency," the PBOC stated in a report last month.

The Chinese yuan showed record gains in September as its share in international payments surged to 5.8%, up from 3.9% at the beginning of the year, outperforming the euro for the first time, data from SWIFT revealed.

The growing share of the yuan in cross-border transactions reflects China's trend of shifting away from the US dollar, as well as Beijing's efforts to promote the use of its national currency.

For more stories on economy & finance visit RT's business section

(RT.com)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of New York Telegraph news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to New York Telegraph.

More InformationBusiness

SectionAI saves $500 million for Microsoft as layoffs reshape strategy

REDMOND, Washington: Artificial intelligence is transforming Microsoft's bottom line. The company saved over US$500 million last year...

FTC’s rule to ease subscription cancellations struck down by court

WASHINGTON, D.C.: A federal rule designed to make it easier for Americans to cancel subscriptions has been blocked by a U.S. appeals...

Musk’s X loses CEO Linda Yaccarino amid AI backlash, ad woes

BASTROP, Texas: In a surprising turn at Elon Musk's X platform, CEO Linda Yaccarino announced she is stepping down, just months after...

Ex-UK PM Sunak takes advisory role at Goldman Sachs

NEW YORK CITY, New York: Former British prime minister Rishi Sunak will return to Goldman Sachs in an advisory role, the Wall Street...

Gold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

PwC: Copper shortages may disrupt 32 percent of chip output by 2035

AMSTERDAM, Netherlands: Some 32 percent of global semiconductor production could face climate change-related copper supply disruptions...

New York

SectionEx-UK PM Sunak takes advisory role at Goldman Sachs

NEW YORK CITY, New York: Former British prime minister Rishi Sunak will return to Goldman Sachs in an advisory role, the Wall Street...

Travelers can now keep shoes on at TSA checkpoints

WASHINGTON, D.C.: Travelers at U.S. airports will no longer need to remove their shoes during security screenings, Department of Homeland...

Stocks slide as Trump unveils 25% tariffs on Japan, S. Korea

NEW YORK CITY, New York: Financial markets kicked off the week on a cautious note as President Donald Trump rolled out a fresh round...

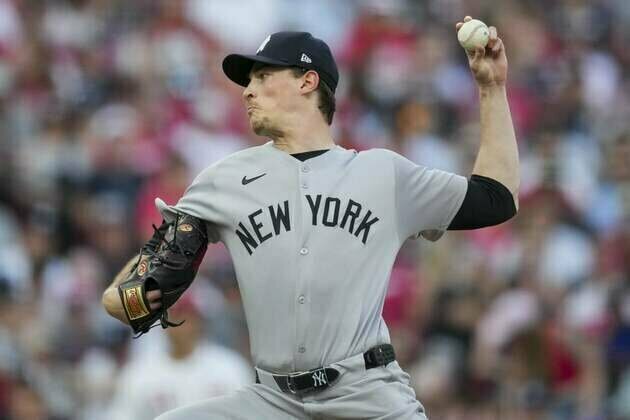

Yankees aim for season-best winning streak against Cubs

(Photo credit: Aaron Doster-Imagn Images) Cody Bellinger spent the past two years rejuvenating his career with the Chicago Cubs....

Kieron Pollard powers MINY into MLC 2025 final with blistering finish

Dallas [US], July 12 (ANI): Kieron Pollard may be a batting coach for Mumbai Indians (MI) in the Indian Premier League (IPL), a fitting...

MLB roundup: Yanks bomb Cubs on Cody Bellinger's 3 HRs

(Photo credit: Wendell Cruz-Imagn Images) Cody Bellinger hit three homers for the first time in his career and drove in six runs,...