Where Is Your Money Safest During a Recession-

iCrowd Newswire

16 Mar 2023, 21:32 GMT+10

With so much turbulence in the economy over inflation, Federal Reserve rate hikes, and the war in Ukraine, it's no wonder that the majority of financial experts are predicting a global recession in 2023. If one does occur, you'll want to take steps now to ensure your finances are well protected. To do that, here are five places to safeguard your money.

1) Cash

Keeping your money in cash certainly doesn't have the same thrill and growth potential as it does with stocks. However, it does offer one very important advantage: You can't lose your principal. This can be incredibly important during a recession - even if the goal is only to protect a specific amount of your principal.

Something else that's very nice about savings accounts is that since the U.S. Federal Reserve started raising interest rates in 2022, banks have been paying decent interest rates again. As of 2023, it's fairly easy to find a reputable online savings account paying between 3.5 and 4.0% interest just for parking your money.

2) Series I bonds

What used to be one of the most ignored investment tools has suddenly become something everyone wants to own: A Series I bond. These are U.S. savings bonds indexed for inflation and currently yielding 6.89%.

Even though this interest rate resets every six months, investors can bet that inflation will be stubborn - especially if the economy falls into a recession. This will be a great place to take virtually no risk and simultaneously earn a decent return.

3) Value stocks

In the world of stock investing, most can be divided into one of two groups: growth and value. Growth stocks take on more risk, while value stocks are more conservative. Therefore, it's safe to assume that growth stocks will be hit harder during a recession.

On top of that, many value stock companies produce consumer staples that people will continue to need and use - in both good times and bad. Even though they wouldn't be immune to the effects of a recession, they'll undoubtedly be more resilient than growth stock companies.

4) Dividend-paying stocks

What's attractive about dividend-paying stocks is that it's a completely passive way to earn money. For doing nothing more than being a shareholder, the company will send you a check every month or quarter just for being a shareholder.

If you don't feel comfortable picking your own stocks, you can choose from dozens of high-yield ETFs (exchange-traded funds) instead. These funds focus on high-quality companies paying attractive dividend rates and ensuring the best returns possible.

5) Life insurance

It might seem strange to think of life insurance as a tool to protect your money during a recession. However, if you understand what life insurance is, you'll quickly see the benefit of it during this time.

Even though a life insurance policy can provide a death benefit to your loved ones, permanent life insurance also comes with a cash value component. This is like a savings account that can accumulate value over time (like an investment account).

Purchasing a permanent life insurance policy will give you a good place to make contributions and watch them mature. By the time another recession hits, you may already have enough saved to borrow against this cash value and use the funds for any purpose you wish.

The bottom line

You don't have to let a recession ruin your financial ambitions. Start safeguarding your money today by putting a portion into a savings account with interest. Continue to earn modest returns by investing in I-bonds, value stocks, and dividend-paying stocks. Additionally, don't forget to utilize the cash value component of a permanent life insurance policy so that you can leverage it for future financial opportunities.

Source: https://www.treasurydirect.gov/news/2022/release-11-02-rates/

See Campaign: https://www.iquanti.com

Contact Information:

Name: Keyonda GoosbyEmail: [email protected] Title: PR Specialist

Tags:Reportedtimes, IPS, Google News, Go Media, CE, ReleaseLive, iCN Internal Distribution, Extended Distribution, English Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of New York Telegraph news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to New York Telegraph.

More InformationBusiness

SectionTech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...

Lululemon accuses Costco of selling knockoff apparel

Vancouver, Canada: A high-stakes legal showdown is brewing in the world of athleisure. Lululemon, the Canadian brand known for its...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Wall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

New York

SectionCOVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

Sam’s Club fulfillment center to shut in Texas, jobs impacted

NEW YORK CITY, New York: Walmart is set to close a major Sam's Club fulfillment center in Fort Worth, Texas, as part of a shift in...

Rent freeze fears hit NYC banks, landlords as Mamdani leads

NEW YORK CITY, New York: New York City's financial markets reacted sharply this week as shares of local banks and real estate investment...

Michelin-star chef Vikas Khanna to bring Assam tea festival to his New York restaurant 'Bungalow'

New York [US], July 1 (ANI): The 200 Years of Assam Tea celebrations at the Summer Fancy Food Show 2025 in New York witnessed a special...

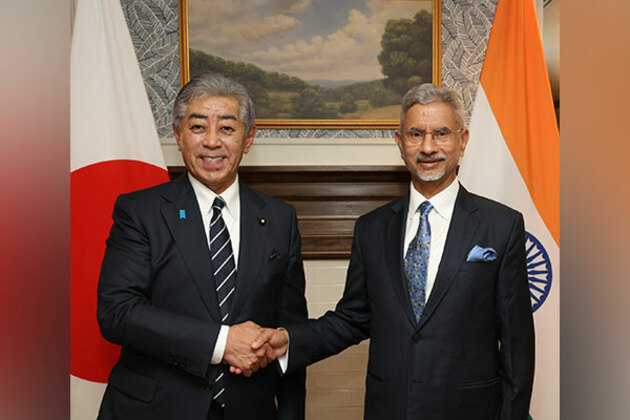

Jaishankar exchange view on deepening Quad engagement for free, open Indo-Pacific with Japan's counterpart

Washington, DC [US], July 1 (ANI): External Affairs Minister S Jaishankar met Japanese Foreign Minister Takeshi Iwaya on the sidelines...