How to Decide Whether Payment Deferment is Right for You

iCrowd Newswire

23 Nov 2022, 22:32 GMT+10

Have you run into financial hardship and are afraid that you won't be able to pay your loan for a few months? Rather than miss a payment and have it count against your credit score, you should request what's called a payment deferment. Here's how deferments work and how you can get one.

How does a loan payment deferment work?

A loan payment deferment is when you and the lender mutually agree to pause making payments. This is only a temporary freeze, and the payments will eventually resume once the deferment period ends (generally after a few months).

Even though this causes a loss of income for the lender, many recognize that hardships happen and are willing to work with borrowers. This is a much more amicable option than missing a payment because it defines clear stop and restart dates for payments. It's also a cheaper option for the lender than taking more drastic measures such as turning the account over to collections.

The good news is that your credit score should not be affected. Because the lender has agreed to freeze payments, they're not technically late or unpaid. The bad news is that in most deferment arrangements, the lender may charge a fee and interest on the loan may still accrue. That means you'll most likely owe more to the lender than when the deferment began.

When is a loan deferment the right choice?

Borrowers who have temporarily fallen behind on payments or experienced a significant hit to their financial situation (such as an unexpected job loss) would be good candidates for loan deferment. However, if the problem with money is larger and delaying the payments will only prolong the inevitable, then other options such as loan consolidation or credit counseling might be better alternatives.

How to get a payment deferment

If you're thinking that a loan deferment might be the right solution for your current financial situation, here's what you can do:

Review your budget

The first thing you'll need to understand is how long you need the deferment to last. Could you be back on track in three or six months? Review your budget and estimate how long it will take to get back on your feet so that you'll know how long to ask for.

Call the lender and request a deferment

The next step is to reach out to the lender directly. Call their customer service and ask to speak to someone about a deferment. Politely explain your situation to the representative.

The lender may ask detailed questions about your income, savings, and other debts. Remember that they have an agenda to be repaid as soon as possible and so they're not going to grant a deferment without making sure that you truly need one.

Ask about any fees or limits

While speaking to the customer representative, be sure to inquire about any fees and whether interest will continue to accrue. Also, ask if there's a limit to the number of deferments you can take.

Sign any required documentation

To make the payment deferment official, the lender may send you documentation to e-sign. If so, carefully review it to ensure that everything that was discussed has been recorded correctly. Be sure to also save this document for future reference.

Prepare for when the payment deferment ends

With the deferment officially in place, don't allow history to repeat itself. Take this time to get your finances in order, prioritize your budget, and develop a viable plan for how you will be able to confidently make those payments once they're scheduled to resume.

The bottom line

Rather than miss a payment, contact your lender and request a deferment instead. If the lender agrees, this could be a mutual benefit that will allow you to temporarily freeze your loan payments, avoid taking a hit on your credit score, and get back on your feet.

See Campaign: https://www.iquanti.com/

Contact Information:

Name: Keyonda Goosby

Email: [email protected]

Job Title: Consultant

Tags:IPS, Reportedtimes, Google News, Go Media, CE, PR-Wirein, ReleaseLive, Financial Content, iCN Internal Distribution, Extended Distribution, English Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of New York Telegraph news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to New York Telegraph.

More InformationBusiness

SectionTech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...

Lululemon accuses Costco of selling knockoff apparel

Vancouver, Canada: A high-stakes legal showdown is brewing in the world of athleisure. Lululemon, the Canadian brand known for its...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Wall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

New York

SectionCOVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

Sam’s Club fulfillment center to shut in Texas, jobs impacted

NEW YORK CITY, New York: Walmart is set to close a major Sam's Club fulfillment center in Fort Worth, Texas, as part of a shift in...

Rent freeze fears hit NYC banks, landlords as Mamdani leads

NEW YORK CITY, New York: New York City's financial markets reacted sharply this week as shares of local banks and real estate investment...

Michelin-star chef Vikas Khanna to bring Assam tea festival to his New York restaurant 'Bungalow'

New York [US], July 1 (ANI): The 200 Years of Assam Tea celebrations at the Summer Fancy Food Show 2025 in New York witnessed a special...

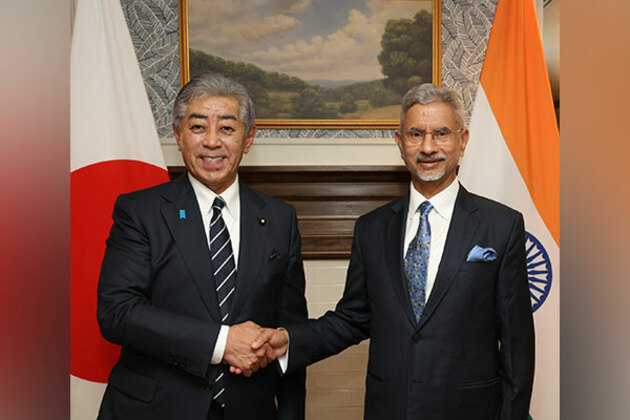

Jaishankar exchange view on deepening Quad engagement for free, open Indo-Pacific with Japan's counterpart

Washington, DC [US], July 1 (ANI): External Affairs Minister S Jaishankar met Japanese Foreign Minister Takeshi Iwaya on the sidelines...